Controlled supply

A fixed money supply, or a supply altered only in accord with objective and calculable criteria, is a necessary condition to a meaningful just price of money.[1]

—Fr. Bernard W. Dempsey, S.J. (1903-1960)

In a centralized economy, currency is issued by a central bank at a rate that is supposed to match the growth of the amount of goods that are exchanged so that these goods can be traded with stable prices. The monetary base is controlled by a central bank. In the United States, the Fed increases the monetary base by issuing currency, increasing the amount banks have on reserve, and more recently, printing money electronically in a process called Quantitative Easing.

In a fully decentralized monetary system, there is no central authority that regulates the monetary base. Instead, currency is created by the nodes of a peer-to-peer network. The Bitcoin generation algorithm defines, in advance, how currency will be created and at what rate. Any currency that is generated by a malicious user that does not follow the rules will be rejected by the network and thus is worthless.

Currency with Finite Supply

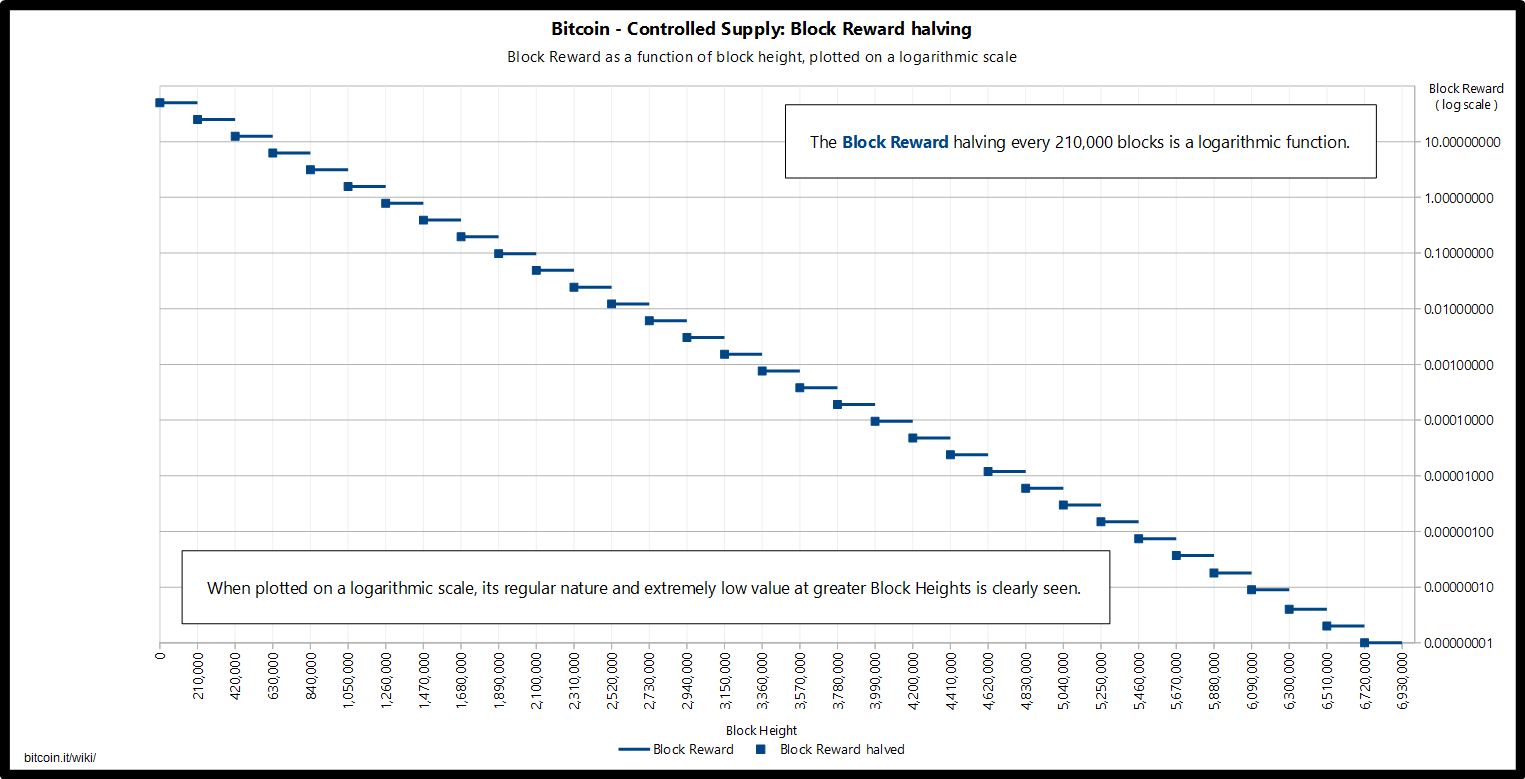

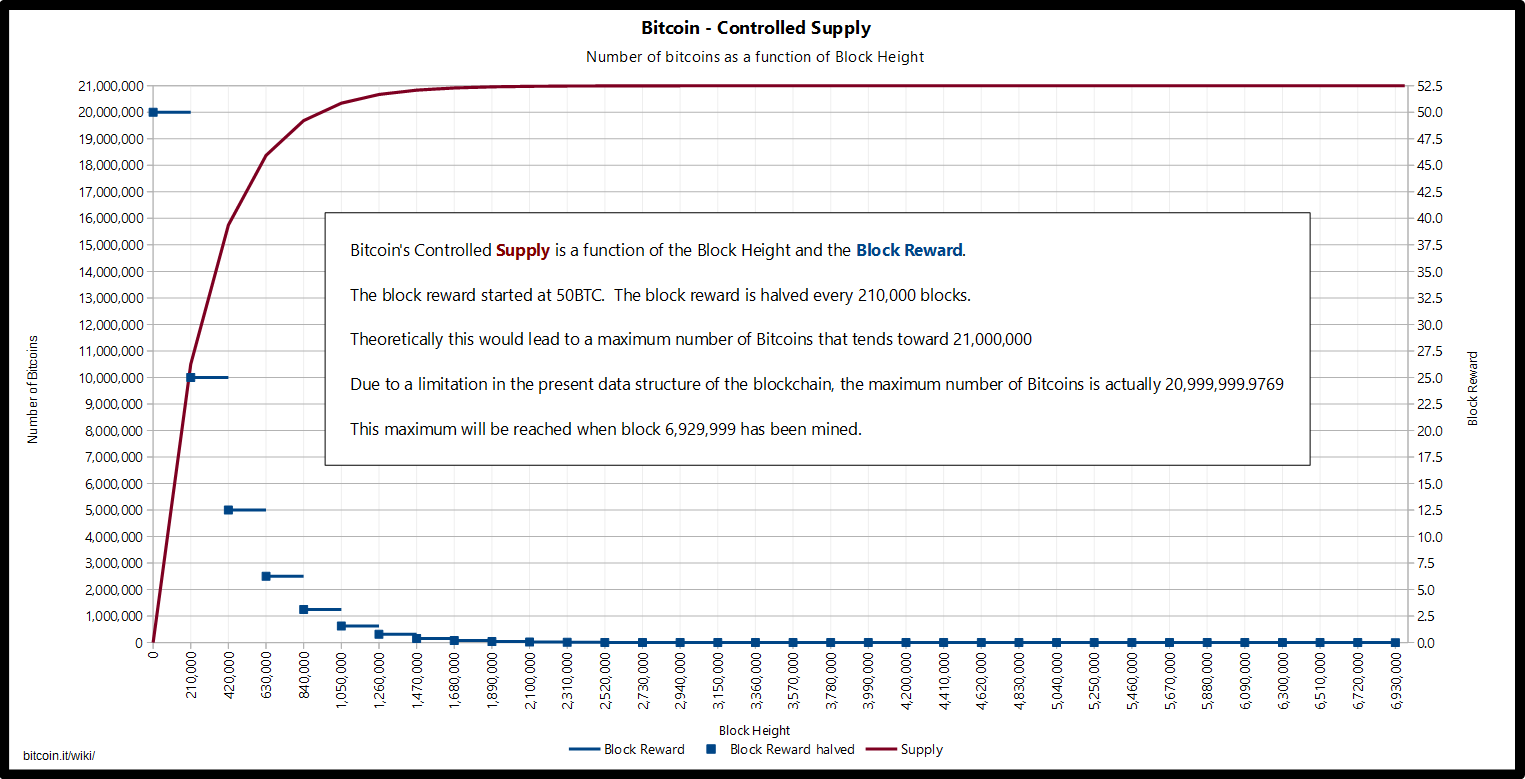

Bitcoins are created each time a user discovers a new block. The rate of block creation is approximately constant over time: 6 per hour. The number of bitcoins generated per block is set to decrease geometrically, with a 50% reduction every four years. The result is that the number of bitcoins in existence will never exceed 21 million.[2] Speculated justifications for the unintuitive value "21 million" are: it matches a 4-year reward halving schedule; or the ultimate total number of Satoshis that will be mined is close to the maximum capacity of a 64-bit floating point number.

This decreasing-supply algorithm was chosen because it approximates the rate at which commodities like gold are mined. Users who use their computers to perform calculations to try and discover a block are thus called Miners.

Projected Bitcoins Short Term

This chart shows the number of bitcoins that will exist in the near future. The Year is a forecast and may be slightly off.

| Date reached | Block | Reward Era | BTC/block | Year (estimate) | Start BTC | BTC Added | End BTC | BTC Increase | End BTC % of Limit |

|---|---|---|---|---|---|---|---|---|---|

| 2009-01-03 | 0 | 1 | 50.00 | 2009 | 0 | 2625000 | 2625000 | infinite | 12.500% |

| 2010-04-22 | 52500 | 1 | 50.00 | 2010 | 2625000 | 2625000 | 5250000 | 100.00% | 25.000% |

| 2011-01-28 | 105000 | 1 | 50.00 | 2011 | 5250000 | 2625000 | 7875000 | 50.00% | 37.500% |

| 2011-12-14 | 157500 | 1 | 50.00 | 2012 | 7875000 | 2625000 | 10500000 | 33.33% | 50.000% |

| 2012-11-28 | 210000 | 2 | 25.00 | 2013 | 10500000 | 1312500 | 11812500 | 12.50% | 56.250% |

| 2013-10-09 | 262500 | 2 | 25.00 | 2014 | 11812500 | 1312500 | 13125000 | 11.11% | 62.500% |

| 2014-08-11 | 315000 | 2 | 25.00 | 2015 | 13125000 | 1312500 | 14437500 | 10.00% | 68.750% |

| 367500 | 2 | 25.00 | 2016 | 14437500 | 1312500 | 15750000 | 9.09% | 75.000% | |

| 420000 | 3 | 12.50 | 2017 | 15750000 | 656250 | 16406250 | 4.17% | 78.125% | |

| 472500 | 3 | 12.50 | 2018 | 16406250 | 656250 | 17062500 | 4.00% | 81.250% | |

| 525000 | 3 | 12.50 | 2019 | 17062500 | 656250 | 17718750 | 3.85% | 84.375% | |

| 577500 | 3 | 12.50 | 2020 | 17718750 | 656250 | 18375000 | 3.70% | 87.500% | |

| 630000 | 4 | 6.25 | 2021 | 18375000 | 328125 | 18703125 | 1.79% | 89.063% | |

| 682500 | 4 | 6.25 | 2022 | 18703125 | 328125 | 19031250 | 1.75% | 90.625% | |

| 735000 | 4 | 6.25 | 2023 | 19031250 | 328125 | 19359375 | 1.72% | 92.188% | |

| 787500 | 4 | 6.25 | 2024 | 19359375 | 328125 | 19687500 | 1.69% | 93.750% |

Projected Bitcoins Long Term

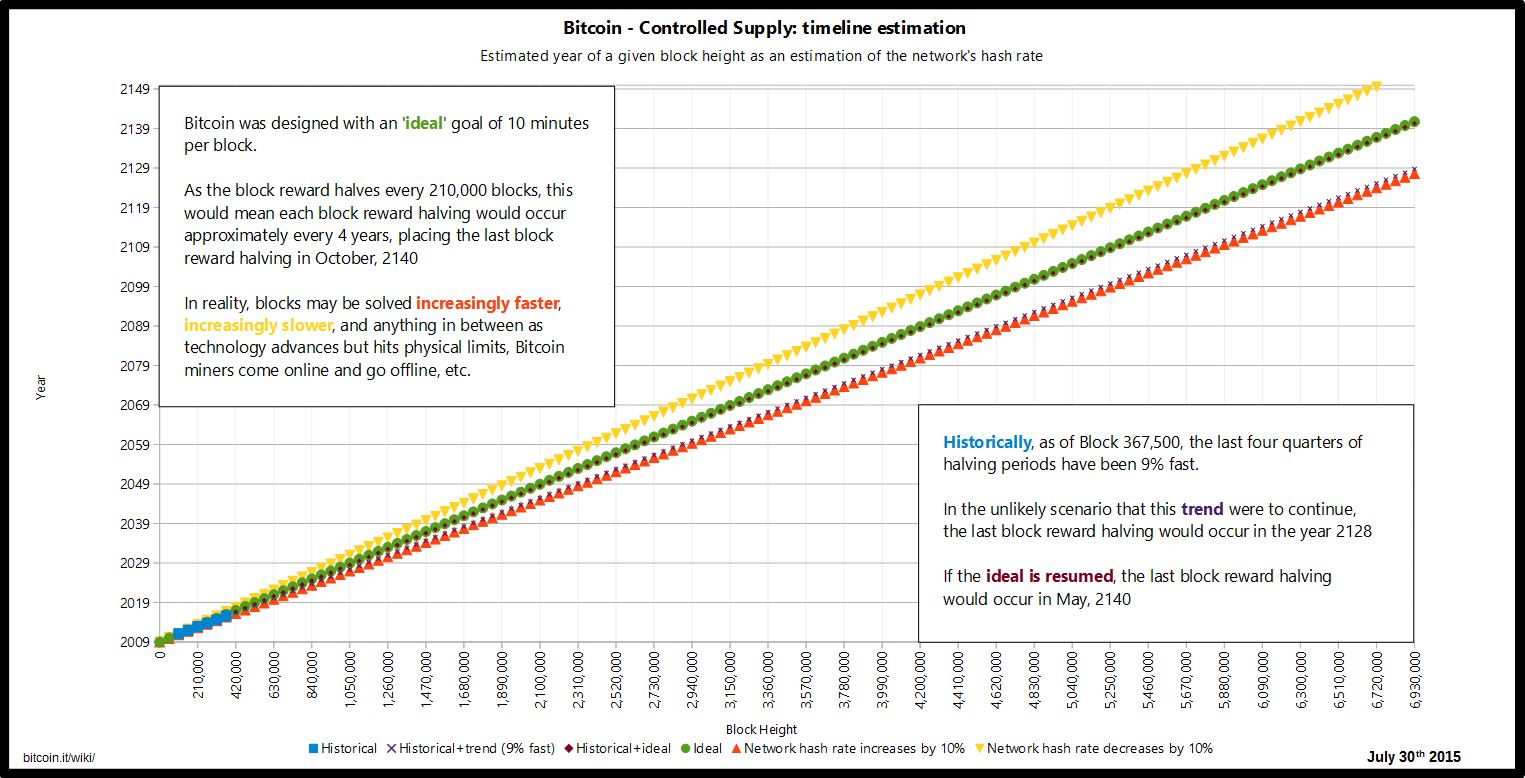

Because the number of bitcoins created each time a user discovers a new block - the block reward - is halved based on a fixed interval of blocks, and the time it takes on average to discover a block can vary based on mining power and the network difficulty, the exact time when the block reward is halved can vary as well. Consequently, the time the last Bitcoin will be created will also vary, and is subject to speculation based on assumptions.

If the mining power had remained constant since the first Bitcoin was mined, the last Bitcoin would have been mined on October 8th, 2140. Due to the mining power having increased overall over time, as of block NNNNNN, assuming mining power remains constant at that point, the last Bitcoin would be mined on May 19th, 2140.

As it is very difficulty to predict how mining power will evolve going into the future - i.e. whether technological progress will continue to make hardware faster or whether mining will hit a a technological wall, or whether or not faster methods of calculation will be discovered - putting an exact date or even year on this event is difficult as well.

The total number of bitcoins, as mentioned earlier, will tend toward 21 million. Due to a technical limitation in the data structure of the blockchain - specifically of the transaction output, this exact value is 20,999,999.9769 bitcoin. Should this technical limitation is adjusted, the total number will still only be a maximum of 21 million.

| Block | Reward Era | BTC/block | Year | Start BTC | BTC Added | End BTC | BTC Increase | End BTC % of Limit |

|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 50.00000000 | 2009.007 | 0.00000000 | 10500000.00000000 | 10500000.00000000 | infinite | 50.00000006% |

| 210000 | 2 | 25.00000000 | 2013.000 | 10500000.00000000 | 5250000.00000000 | 15750000.00000000 | 50.00000000% | 75.00000008% |

| 420000 | 3 | 12.50000000 | 2016.993 | 15750000.00000000 | 2625000.00000000 | 18375000.00000000 | 16.66666667% | 87.50000010% |

| 630000 | 4 | 6.25000000 | 2020.986 | 18375000.00000000 | 1312500.00000000 | 19687500.00000000 | 7.14285714% | 93.75000010% |

| 840000 | 5 | 3.12500000 | 2024.978 | 19687500.00000000 | 656250.00000000 | 20343750.00000000 | 3.33333333% | 96.87500011% |

| 1050000 | 6 | 1.56250000 | 2028.971 | 20343750.00000000 | 328125.00000000 | 20671875.00000000 | 1.61290323% | 98.43750011% |

| 1260000 | 7 | 0.78125000 | 2032.964 | 20671875.00000000 | 164062.50000000 | 20835937.50000000 | 0.79365079% | 99.21875011% |

| 1470000 | 8 | 0.39062500 | 2036.956 | 20835937.50000000 | 82031.25000000 | 20917968.75000000 | 0.39370079% | 99.60937511% |

| 1680000 | 9 | 0.19531250 | 2040.949 | 20917968.75000000 | 41015.62500000 | 20958984.37500000 | 0.19607843% | 99.80468761% |

| 1890000 | 10 | 0.09765625 | 2044.942 | 20958984.37500000 | 20507.81250000 | 20979492.18750000 | 0.09784736% | 99.90234386% |

| 2100000 | 11 | 0.04882812 | 2048.934 | 20979492.18750000 | 10253.90520000 | 20989746.09270000 | 0.04887585% | 99.95117198% |

| 2310000 | 12 | 0.02441406 | 2052.927 | 20989746.09270000 | 5126.95260000 | 20994873.04530000 | 0.02442599% | 99.97558604% |

| 2520000 | 13 | 0.01220703 | 2056.920 | 20994873.04530000 | 2563.47630000 | 20997436.52160000 | 0.01221001% | 99.98779307% |

| 2730000 | 14 | 0.00610351 | 2060.913 | 20997436.52160000 | 1281.73710000 | 20998718.25870000 | 0.00610426% | 99.99389658% |

| 2940000 | 15 | 0.00305175 | 2064.905 | 20998718.25870000 | 640.86750000 | 20999359.12620000 | 0.00305194% | 99.99694833% |

| 3150000 | 16 | 0.00152587 | 2068.898 | 20999359.12620000 | 320.43270000 | 20999679.55890000 | 0.00152592% | 99.99847420% |

| 3360000 | 17 | 0.00076293 | 2072.891 | 20999679.55890000 | 160.21530000 | 20999839.77420000 | 0.00076294% | 99.99923713% |

| 3570000 | 18 | 0.00038146 | 2076.883 | 20999839.77420000 | 80.10660000 | 20999919.88080000 | 0.00038146% | 99.99961859% |

| 3780000 | 19 | 0.00019073 | 2080.876 | 20999919.88080000 | 40.05330000 | 20999959.93410000 | 0.00019073% | 99.99980932% |

| 3990000 | 20 | 0.00009536 | 2084.869 | 20999959.93410000 | 20.02560000 | 20999979.95970000 | 0.00009536% | 99.99990468% |

| 4200000 | 21 | 0.00004768 | 2088.861 | 20999979.95970000 | 10.01280000 | 20999989.97250000 | 0.00004768% | 99.99995236% |

| 4410000 | 22 | 0.00002384 | 2092.854 | 20999989.97250000 | 5.00640000 | 20999994.97890000 | 0.00002384% | 99.99997620% |

| 4620000 | 23 | 0.00001192 | 2096.847 | 20999994.97890000 | 2.50320000 | 20999997.48210000 | 0.00001192% | 99.99998812% |

| 4830000 | 24 | 0.00000596 | 2100.840 | 20999997.48210000 | 1.25160000 | 20999998.73370000 | 0.00000596% | 99.99999408% |

| 5040000 | 25 | 0.00000298 | 2104.832 | 20999998.73370000 | 0.62580000 | 20999999.35950000 | 0.00000298% | 99.99999706% |

| 5250000 | 26 | 0.00000149 | 2108.825 | 20999999.35950000 | 0.31290000 | 20999999.67240000 | 0.00000149% | 99.99999855% |

| 5460000 | 27 | 0.00000074 | 2112.818 | 20999999.67240000 | 0.15540000 | 20999999.82780000 | 0.00000074% | 99.99999929% |

| 5670000 | 28 | 0.00000037 | 2116.810 | 20999999.82780000 | 0.07770000 | 20999999.90550000 | 0.00000037% | 99.99999966% |

| 5880000 | 29 | 0.00000018 | 2120.803 | 20999999.90550000 | 0.03780000 | 20999999.94330000 | 0.00000018% | 99.99999984% |

| 6090000 | 30 | 0.00000009 | 2124.796 | 20999999.94330000 | 0.01890000 | 20999999.96220000 | 0.00000009% | 99.99999993% |

| 6300000 | 31 | 0.00000004 | 2128.788 | 20999999.96220000 | 0.00840000 | 20999999.97060000 | 0.00000004% | 99.99999997% |

| 6510000 | 32 | 0.00000002 | 2132.781 | 20999999.97060000 | 0.00420000 | 20999999.97480000 | 0.00000002% | 99.99999999% |

| 6720000 | 33 | 0.00000001 | 2136.774 | 20999999.97480000 | 0.00210000 | 20999999.97690000 | 0.00000001% | 100.00000000% |

| 6930000 | 34 | 0.00000000 | 2140.767 | 20999999.97690000 | 0.00000000 | 20999999.97690000 | 0.00000000% | 100.00000000% |

Note: The number of bitcoins are presented in a floating point format. However, these values are based on the number of satoshi per block originally in integer format to prevent compounding error.

Spendable Supply

The theoretical total number of bitcoins, 21 million, should not be confused with the total spendable supply. The total spendable supply is always lower than the theoretical total supply, and is subject to accidental loss, willful destruction, and technical peculiarities.

Loss of bitcoin

Bitcoins may be lost if the conditions required to spend them are no longer known. For example, if you made a transaction to an address that requires a private key in order to spend those bitcoins further, had written that private key down on a piece of paper, but that piece of paper was lost. In this case, that bitcoin may also be considered lost, as the odds of randomly finding a matching private key are such that it is generally considered impossible.

Willful destruction of bitcoin

Bitcoins may also be willfully 'destroyed' - for example by attaching conditions that make it impossible to spend them.

A common method is to send bitcoin to an address that was constructed and only made to pass validity checks, but for which no private key is actually known. An example of such an address is "1BitcoinEaterAddressDontSendf59kuE", where the last "f59kuE" is text to make the preceding constructed text pass validation. Finding a matching private key is, again, generally considered impossible. For an example of how difficult this would be, see Vanitygen.

Another common method is to send bitcoin in a transaction where the conditions for spending are not just unfathomably unlikely, but literally impossible to meet. For example, a transaction that is made provably unspendable using OP_RETURN, or uses script operations that requires the user to prove that 1+1 equals 3.

A lesser known method is to send bitcoin to an address based on private key that is outside the range of valid ECDSA private keys. For example, the address 16QaFeudRUt8NYy2yzjm3BMvG4xBbAsBFM has a known matching private key of value 0 (zero), which is outside the valid range.

Technical peculiarities preventing spending of bitcoin

There are also technical peculiarities that prevent the spending of some bitcoin.

The first 50 bitcoin, included in the genesis block, cannot be spent as its transaction is not in the global database.

Money Supply

While the number of bitcoins in existence will never exceed 21 million, the money supply of bitcoins can exceed 21 million due to Fractional-reserve Banking.

Deflation

Because the monetary base of bitcoins cannot be expanded, the currency would be subject to severe deflation if it becomes widely used. Keynesian economists argue that deflation is bad for an economy because it incentivises individuals and businesses to save money rather than invest in businesses and create jobs. The Austrian school of thought counters this criticism, claiming that as deflation occurs in all stages of production, entrepreneurs who invest benefit from it. As a result, profit ratios tend to stay the same and only their magnitudes change. In other words, in a deflationary environment, goods and services decrease in price, but at the same time the cost for the production of these goods and services tend to decrease proportionally, effectively not affecting profits. Price deflation encourages an increase in hoarding — hence savings — which in turn tends to lower interest rates and increase the incentive for entrepreneurs to invest in projects of longer term.

See also

- Milton Friedman interview, where he proposed to replace the central bank with a computer, and to fix the money supply growth at 4% annually

- Deflationary spiral

- Chart of total bitcoins in circulation

References

- ↑ Interest and Usury p. 220 by Fr. Bernard W. Dempsey, S.J. (1903-1960); cf. John Horvat II Return to Order ch. 37 "The Backing of Money"

- ↑ 21 million cap